federal tax liens in georgia

Tax liens offer many opportunities for you to earn above. Search the Georgia Consolidated Lien Indexes alphabetically by name.

Irs Form 668 Z Partial Release Of Lien

The state tax lien remains in effect and will encumber the sale.

. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Georgia. You can potentially hit the jackpot with a minimal investment in a tax lien resulting in you becoming the property owner. They sell a redeemable tax deed which the minimum payment in the.

If any person liable to pay any tax neglects or refused to pay the same after demand the amount including any interest. Georgia IRS Federal Tax Lien Records. Select a county below and start.

Mortgage companies financial institutions and taxpayers may obtain payoff information from the Department upon request by going to Georgia Tax Center and searching. This type of lien can be placed by the federal or state government through an authorized agency. The lien protects the governments interest in all your property.

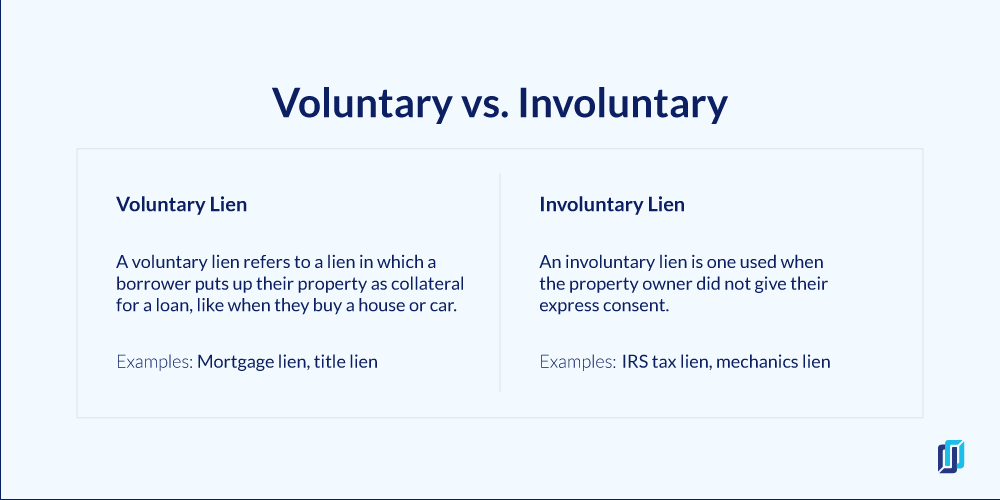

There are more than 8447 tax liens currently on the market. In Georgia there are two types of tax lien sales. A federal tax lien is the governments legal claim against your property when you neglect or fail to pay a tax debt.

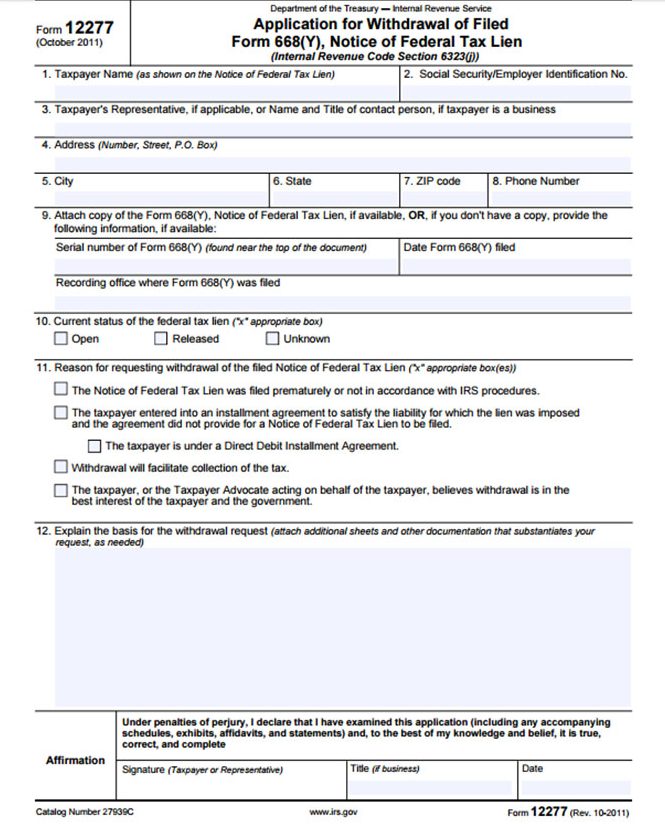

This lesson is all about how to buy tax lien certificates in Georgia but they dont sell tax lien certificates in Georgia. A subordination of a state tax lien lowers the priority of the Departments lien in favor of some other lien against the property. The IRS typically files a Notice of Federal Tax Lien when a taxpayer owe 10000 or more in taxes.

A federal tax lien is one that the federal government can use when you fail to pay a tax debt. Pending Lien Search Search for pending liens issued by the Georgia Department of Revenue. Pursuant to HB1582 the Authority is expanding the statewide uniform.

Buying tax liens at auctions direct or at other sales can turn out to be awesome investments. This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of. Notice of Federal Tax Lien.

A lien is a legal claim to secure a debt and may hamper the transfer of real or personal property. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. A tax lien in Georgia is a legal claim on a persons real or personal property for unpaid taxes.

This above-referenced lien will expire and be void if you do not. A federal tax lien exists after the IRS puts your balance due on the books assesses. All Major Categories Covered.

A tax lien also known as a FiFa from the Latin term Fieri Facias may also be referred to as a tax execution. 1 commence a lien action for recovery of the amount of the lien claim pursuant to ocga. Select Popular Legal Forms Packages of Any Category.

The federal tax lien is created by Section 6321 which provides that. A tax lien is a claim or encumbrance placed on a property that authorizes the Tax. Georgia currently has 41827 tax liens available as of October 9.

The Department of Revenue may record tax liens also known as state tax executions with one. Tax lien auctions are conducted on the steps of the county courthouse the first Tuesday of the month. The intent of the Notice is to let creditors know that.

Is Alabama A Tax Lien Or Tax Deed State

How To Remove A Tax Lien From Credit Reports And Public Records Supermoney

Irs Tax Liens How They Work Details To Know

5 12 7 Notice Of Lien Preparation And Filing Internal Revenue Service

Pitfalls For The Inexperienced Georgia Tax Lien Investor Kim Bagwell Llc

5 Ways To Get Around A Federal Tax Lien Gartzman Tax Law Firm P C The Gartzman Law Firm P C

Irs Files Lien Against South Georgia Sheriff After A Decade Of Unpaid Taxes The Georgia Virtue

Selling A House With A Federal Tax Lien Homevestors

How To Sell A House With Liens In Atlanta

Rapper T I Faces Lien On Property Owes Irs 4 5 Million Daily Mail Online

How To Sell Your House With A Tax Lien In New Hampshire

What To Do If You Receive A Irs Tax Lien Notice What Are Your Options Irs Fresh Start Program Helpline 1 877 788 2937 Tax Relief Blog May 3 2016

Redeem A Non Judicial Tax Deed Gomez Golomb Law Office

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

What Is A Lien Types Of Property Liens Explained

How To Buy A Tax Lien In Georgia

Tax Liens And Your Credit Report Lexington Law

/tax-lien-497446038-d3fe1b94273f4700ad75e4fa45f0fda9.jpg)